Lead Arbitrage Explained: Turning a $2 Ad Click Into a $45 Profit

Lead Arbitrage Explained: Turning a $2 Ad Click Into a $45 Profit

Written by

Rafael Hernandez

6 min read

In this post:

In this post:

Section

Turn Ad Spend Into Signed Cases

Turn Ad Spend Into Signed Cases

We blend AI-driven testing with proven performance strategy to attract qualified traffic and turn it into revenue—fast, trackable, and scalable.

Spanish MVA Leads — get exclusive, high-intent cases from the untapped Hispanic market. (New!)

Facebook & Instagram Ads — reach customers where they scroll.

Google Ads — capture people actively searching for you.

Website Design — turn visitors into buyers with high-converting sites.

AI Automations — save hours and never miss a follow-up.

Email Marketing — nurture leads and close sales on autopilot.

SEO — get found by customers searching for what you sell.

We blend AI-driven testing with proven performance strategy to attract qualified traffic and turn it into revenue—fast, trackable, and scalable.

Spanish MVA Leads — get exclusive, high-intent cases from the untapped Hispanic market. (New!)

Facebook & Instagram Ads — reach customers where they scroll.

Google Ads — capture people actively searching for you.

Website Design — turn visitors into buyers with high-converting sites.

AI Automations — save hours and never miss a follow-up.

Email Marketing — nurture leads and close sales on autopilot.

SEO — get found by customers searching for what you sell.

Key Takeaways

Lead arbitrage is essentially buying traffic at a lower cost and reselling the generated leads at a premium to businesses who need them.

The pay per lead model allows you to act as the "hunter," gathering potential customers, while the client acts as the "chef" who closes the deal.

Success in lead flipping relies heavily on generating valid, high-quality data rather than just high volume.

Major companies like NerdWallet and LendingTree are built entirely on lead arbitrage principles.

You can scale this model indefinitely by increasing ad spend as long as your profit margins remain healthy.

Lead arbitrage is essentially buying traffic at a lower cost and reselling the generated leads at a premium to businesses who need them.

The pay per lead model allows you to act as the "hunter," gathering potential customers, while the client acts as the "chef" who closes the deal.

Success in lead flipping relies heavily on generating valid, high-quality data rather than just high volume.

Major companies like NerdWallet and LendingTree are built entirely on lead arbitrage principles.

You can scale this model indefinitely by increasing ad spend as long as your profit margins remain healthy.

Lead Arbitrage Explained: Turning a $2 Ad Click Into a $45 Profit

Imagine a business model where you do not need a warehouse, you do not need to manage inventory, and you do not even need to handle the final product delivery. All you need are skills and systems. This is the reality of lead arbitrage. It is often described as the digital equivalent of day trading. You buy attention from platforms like Facebook for a low price, generate a lead, and then sell that data to a business for a significantly higher price.

For many digital marketers and agencies, this shift represents a massive opportunity to move beyond standard retainers. Whether you are an advertising agency in California or a solo entrepreneur, understanding how to buy traffic for $10 and sell it for $25 is a game changer. In this post, we will break down exactly how this model works, explore real-world success stories like Lower My Bills, and show you the math behind the money.

What Is Lead Arbitrage? (The Digital Day Trading Model)

At its core, lead arbitrage is a simple concept. You are capitalizing on the difference between the cost of acquiring a potential customer and the value that a business places on that customer. It is a digital day trading business where the asset is not a stock or a currency but human attention.

In a traditional agency model, you might charge a monthly fee to manage ads. In an arbitrage model, you take on the risk and the reward. You spend your own money to generate leads. If you spend $5 to get a person to fill out a form and a bank pays you $25 for that lead, you keep the $20 profit. You repeat this cycle as many times as possible.

This model is powerful because it removes the ceiling on your income. You are not trading time for money. You are trading data for money. The better you get at acquiring attention cheaply, the higher your profit margins become.

The Mechanics of the Pay Per Lead Model

To understand the pay per lead model, it helps to use an analogy. Think of yourself as the hunter and your client (the buyer) as the chef.

The Hunter (You): You go into the "forest" (Facebook, Google, TikTok) to find the "deer" (leads). Your job is to capture attention and collect data.

The Chef (The Buyer): The buyer is a business, such as a mortgage broker or a bank. They do not want to hunt. They want to cook. They buy the "deer" from you so they can prepare the meal (close the sale).

The Network (The Grocery Store): Sometimes there is a middleman, like an affiliate network, that connects hunters to chefs.

The Aggregator (The Wholesaler): Large companies that buy leads in massive bulk to resell them.

If you run a marketing agency in Los Angeles, transitioning to this model means you stop selling hours and start selling results. You become the affiliate or publisher, while the company buying the data is the advertiser. Understanding the dynamic of affiliate publisher vs advertiser is critical here. You own the traffic and the data, which gives you significant leverage in the market.

Real-World Lead Arbitrage Case Studies

You might think this is a small niche, but some of the biggest companies on the internet are built on lead arbitrage. Let’s look at a few famous lead arbitrage case studies.

Lower My Bills

One of the most famous examples is Lower My Bills. You might remember their quirky, sometimes "ugly" ads. They did not have a fancy product. Their entire business was aggregating data. They drove traffic, collected user information for loans and mortgages, and sold that data to banks. In 2005, Experian bought them for over $300 million. This proved that you do not need a pretty product. You just need traffic and conversions.

NerdWallet and LendingTree

Companies like NerdWallet appear to be helpful content sites, but they are essentially lead aggregation platforms. They offer advice on "best credit cards" or "mortgage rates." When you click an offer, they are selling your interest to a financial institution. They act as the hunter, doing the research and gathering the audience, and then they sell that high-intent traffic to the banks.

This demonstrates that lead flipping can be built into a massive, legitimate brand. You are providing value by connecting a consumer who needs a service with a provider who offers it.

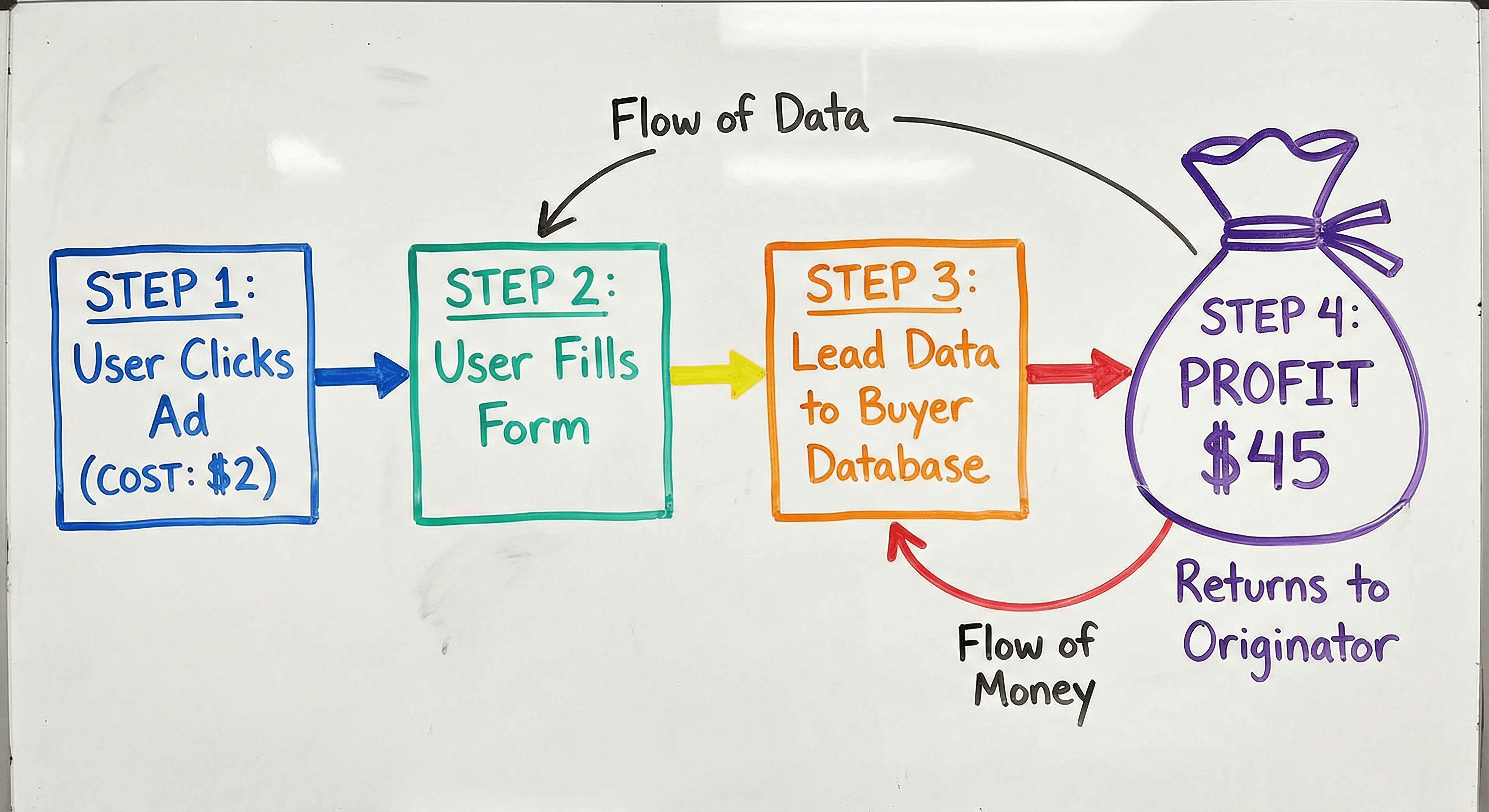

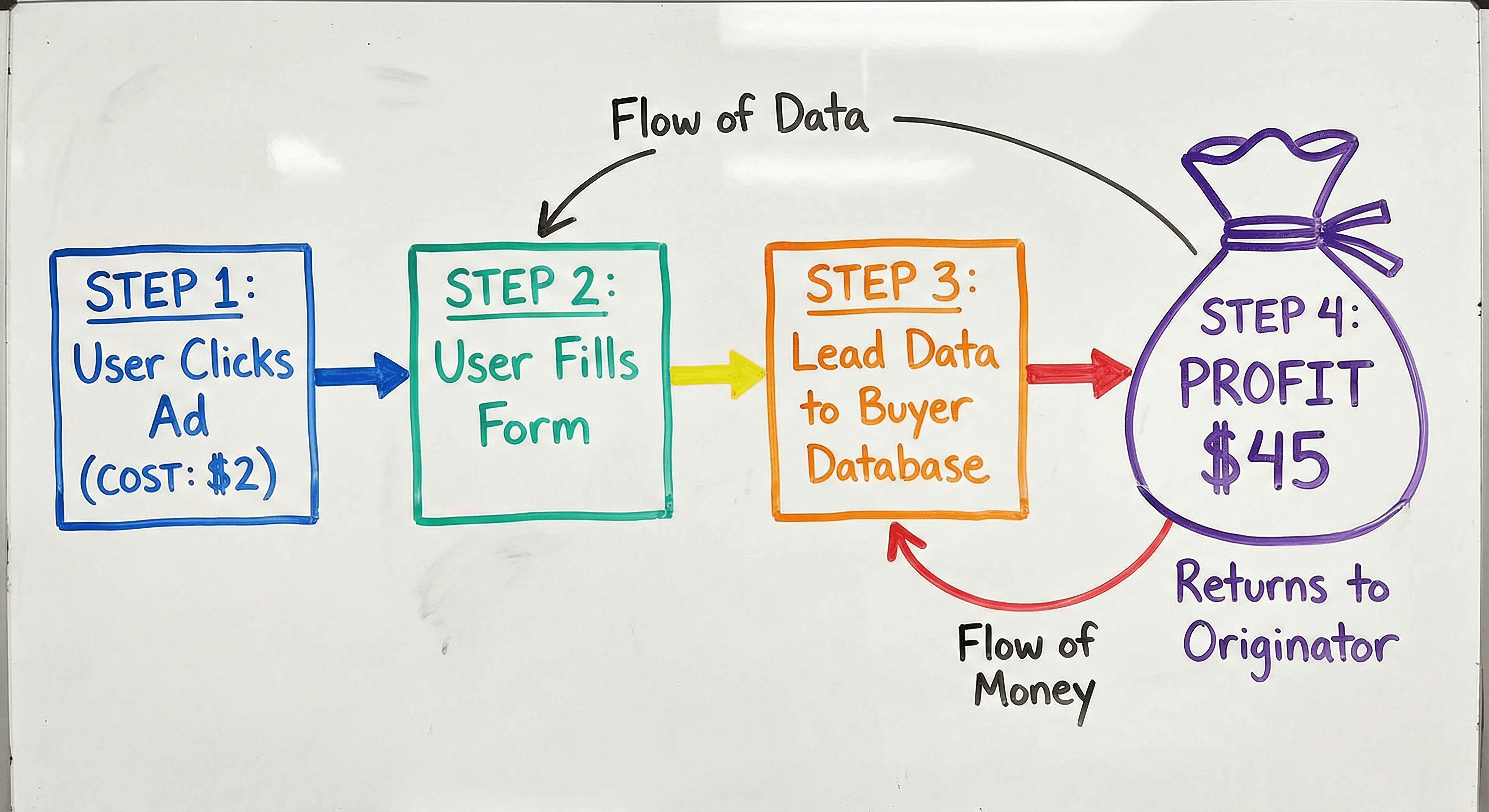

The Math Behind the Money

The beauty of lead arbitrage lies in the numbers. It is a game of margins. Let’s break down a hypothetical cost per lead calculation to see how the profits stack up.

Imagine you are running ads for a mortgage offer:

Cost Per Click (CPC): You pay $2.00 for a click on Facebook.

Conversion Rate: 10% of people who click fill out the form.

Cost Per Lead (CPL): It costs you $20.00 to generate one lead ($2.00 / 0.10).

Sale Price: A mortgage broker pays you $65.00 for that exclusive lead.

Profit: You make $45.00 per lead.

If you can generate 100 leads a day, that is $4,500 in daily profit. This is why earnings per click analysis is vital. You need to know exactly how much you can spend to acquire a customer while staying profitable. For those interested in cpa marketing for beginners, this math is the foundation of your entire business. If you know you can spend $20 to make $65, you will spend that $20 as many times as possible.

If you are looking for an advertising agency in Los Angeles to help you crunch these numbers and set up the infrastructure, ensure they understand these specific unit economics.

How to Scale and Optimize Your Campaigns

Scaling a pay per lead model is different from scaling a branding campaign. In branding, you want reach. In arbitrage, you want valid data. One of the biggest challenges is generating valid leads for clients. If you send "junk" leads (people with bad phone numbers or who are not interested), the buyer will stop purchasing from you. You must prioritize quality over quantity in lead gen.

Optimization Tactics

To maintain high quality while scaling, you need advanced media buying strategies for agencies.

Creative Testing: You must constantly test new images and hooks to keep click costs down.

Form Optimization: Facebook lead forms optimization is crucial. Asking too few questions leads to low intent. Asking too many raises your cost. You have to find the "Goldilocks" zone.

Tech Stack: You need automation to verify phone numbers and distribute leads instantly.

We recently converted some mortgage broker clients from a retainer model to a pay-per-lead model. The results were exciting. It required us to build a new division focused solely on performance. If you need a specialized Facebook advertising agency to handle this transition, look for one that understands the technical backend of lead distribution.

Lead Flipping vs. Traditional Agency Retainers

The traditional agency model is safe but limited. You trade time for a flat fee. Lead flipping and arbitrage are high-risk, high-reward.

Retainer: You get paid whether the ads work or not (though you might get fired if they do not).

Arbitrage: You only make money if you deliver results.

However, arbitrage allows for infinite scale. In a retainer model, you need more account managers to handle more clients. In arbitrage, you just need to increase your ad spend on the campaigns that are winning. You utilize lead distribution networks to route the data automatically.

For agencies, this opens up a new revenue stream. You can have hybrid models where you keep some stable retainers while using your media buying expertise to build an arbitrage engine on the side. If you are a Los Angeles ad agency, diversifying into this model can protect you from client churn.

Expanding Into Specific Niches

While the concept applies broadly, specific niches work best for lead arbitrage. Financial services, insurance, home improvement, and legal services are the giants of this industry. For example, mortgage lead generation strategies are highly developed because the payout for a closed loan is massive. A bank is willing to pay $50, $100, or even more for a qualified lead because that customer is worth thousands of dollars to them.

If you are running Facebook ads California wide for solar panels or debt relief, the competition is fierce, but the payouts are high. The key is to find a niche where the buyer has a high lifetime value for the customer, allowing them to pay you a premium for the lead.

Lead Arbitrage Explained: Turning a $2 Ad Click Into a $45 Profit

Imagine a business model where you do not need a warehouse, you do not need to manage inventory, and you do not even need to handle the final product delivery. All you need are skills and systems. This is the reality of lead arbitrage. It is often described as the digital equivalent of day trading. You buy attention from platforms like Facebook for a low price, generate a lead, and then sell that data to a business for a significantly higher price.

For many digital marketers and agencies, this shift represents a massive opportunity to move beyond standard retainers. Whether you are an advertising agency in California or a solo entrepreneur, understanding how to buy traffic for $10 and sell it for $25 is a game changer. In this post, we will break down exactly how this model works, explore real-world success stories like Lower My Bills, and show you the math behind the money.

What Is Lead Arbitrage? (The Digital Day Trading Model)

At its core, lead arbitrage is a simple concept. You are capitalizing on the difference between the cost of acquiring a potential customer and the value that a business places on that customer. It is a digital day trading business where the asset is not a stock or a currency but human attention.

In a traditional agency model, you might charge a monthly fee to manage ads. In an arbitrage model, you take on the risk and the reward. You spend your own money to generate leads. If you spend $5 to get a person to fill out a form and a bank pays you $25 for that lead, you keep the $20 profit. You repeat this cycle as many times as possible.

This model is powerful because it removes the ceiling on your income. You are not trading time for money. You are trading data for money. The better you get at acquiring attention cheaply, the higher your profit margins become.

The Mechanics of the Pay Per Lead Model

To understand the pay per lead model, it helps to use an analogy. Think of yourself as the hunter and your client (the buyer) as the chef.

The Hunter (You): You go into the "forest" (Facebook, Google, TikTok) to find the "deer" (leads). Your job is to capture attention and collect data.

The Chef (The Buyer): The buyer is a business, such as a mortgage broker or a bank. They do not want to hunt. They want to cook. They buy the "deer" from you so they can prepare the meal (close the sale).

The Network (The Grocery Store): Sometimes there is a middleman, like an affiliate network, that connects hunters to chefs.

The Aggregator (The Wholesaler): Large companies that buy leads in massive bulk to resell them.

If you run a marketing agency in Los Angeles, transitioning to this model means you stop selling hours and start selling results. You become the affiliate or publisher, while the company buying the data is the advertiser. Understanding the dynamic of affiliate publisher vs advertiser is critical here. You own the traffic and the data, which gives you significant leverage in the market.

Real-World Lead Arbitrage Case Studies

You might think this is a small niche, but some of the biggest companies on the internet are built on lead arbitrage. Let’s look at a few famous lead arbitrage case studies.

Lower My Bills

One of the most famous examples is Lower My Bills. You might remember their quirky, sometimes "ugly" ads. They did not have a fancy product. Their entire business was aggregating data. They drove traffic, collected user information for loans and mortgages, and sold that data to banks. In 2005, Experian bought them for over $300 million. This proved that you do not need a pretty product. You just need traffic and conversions.

NerdWallet and LendingTree

Companies like NerdWallet appear to be helpful content sites, but they are essentially lead aggregation platforms. They offer advice on "best credit cards" or "mortgage rates." When you click an offer, they are selling your interest to a financial institution. They act as the hunter, doing the research and gathering the audience, and then they sell that high-intent traffic to the banks.

This demonstrates that lead flipping can be built into a massive, legitimate brand. You are providing value by connecting a consumer who needs a service with a provider who offers it.

The Math Behind the Money

The beauty of lead arbitrage lies in the numbers. It is a game of margins. Let’s break down a hypothetical cost per lead calculation to see how the profits stack up.

Imagine you are running ads for a mortgage offer:

Cost Per Click (CPC): You pay $2.00 for a click on Facebook.

Conversion Rate: 10% of people who click fill out the form.

Cost Per Lead (CPL): It costs you $20.00 to generate one lead ($2.00 / 0.10).

Sale Price: A mortgage broker pays you $65.00 for that exclusive lead.

Profit: You make $45.00 per lead.

If you can generate 100 leads a day, that is $4,500 in daily profit. This is why earnings per click analysis is vital. You need to know exactly how much you can spend to acquire a customer while staying profitable. For those interested in cpa marketing for beginners, this math is the foundation of your entire business. If you know you can spend $20 to make $65, you will spend that $20 as many times as possible.

If you are looking for an advertising agency in Los Angeles to help you crunch these numbers and set up the infrastructure, ensure they understand these specific unit economics.

How to Scale and Optimize Your Campaigns

Scaling a pay per lead model is different from scaling a branding campaign. In branding, you want reach. In arbitrage, you want valid data. One of the biggest challenges is generating valid leads for clients. If you send "junk" leads (people with bad phone numbers or who are not interested), the buyer will stop purchasing from you. You must prioritize quality over quantity in lead gen.

Optimization Tactics

To maintain high quality while scaling, you need advanced media buying strategies for agencies.

Creative Testing: You must constantly test new images and hooks to keep click costs down.

Form Optimization: Facebook lead forms optimization is crucial. Asking too few questions leads to low intent. Asking too many raises your cost. You have to find the "Goldilocks" zone.

Tech Stack: You need automation to verify phone numbers and distribute leads instantly.

We recently converted some mortgage broker clients from a retainer model to a pay-per-lead model. The results were exciting. It required us to build a new division focused solely on performance. If you need a specialized Facebook advertising agency to handle this transition, look for one that understands the technical backend of lead distribution.

Lead Flipping vs. Traditional Agency Retainers

The traditional agency model is safe but limited. You trade time for a flat fee. Lead flipping and arbitrage are high-risk, high-reward.

Retainer: You get paid whether the ads work or not (though you might get fired if they do not).

Arbitrage: You only make money if you deliver results.

However, arbitrage allows for infinite scale. In a retainer model, you need more account managers to handle more clients. In arbitrage, you just need to increase your ad spend on the campaigns that are winning. You utilize lead distribution networks to route the data automatically.

For agencies, this opens up a new revenue stream. You can have hybrid models where you keep some stable retainers while using your media buying expertise to build an arbitrage engine on the side. If you are a Los Angeles ad agency, diversifying into this model can protect you from client churn.

Expanding Into Specific Niches

While the concept applies broadly, specific niches work best for lead arbitrage. Financial services, insurance, home improvement, and legal services are the giants of this industry. For example, mortgage lead generation strategies are highly developed because the payout for a closed loan is massive. A bank is willing to pay $50, $100, or even more for a qualified lead because that customer is worth thousands of dollars to them.

If you are running Facebook ads California wide for solar panels or debt relief, the competition is fierce, but the payouts are high. The key is to find a niche where the buyer has a high lifetime value for the customer, allowing them to pay you a premium for the lead.

FAQs

Is lead arbitrage legal?

Yes, lead arbitrage is completely legal. It is a standard business practice used by major corporations like LendingTree and Expedia. However, you must remain compliant with data privacy laws such as GDPR and CCPA. You must clearly disclose to the user that their data may be shared with partners. Transparency is key to building a sustainable business in this space.

How much money do I need to start lead flipping?

You do not need millions, but you do need a testing budget. Since you are paying for ads upfront, you need enough capital to gather data and optimize your campaigns before you become profitable. Typically, a few thousand dollars is recommended to start testing different creatives and audiences effectively.

What niches are best for lead arbitrage?

High-ticket service-based niches work best. This includes mortgage, solar, insurance, debt settlement, and legal services. These industries have high customer values, meaning companies are willing to pay a premium for valid leads. Low-ticket items usually do not offer enough margin to make the arbitrage math work.

Do I need a website for lead arbitrage?

Not necessarily, but it helps. You can run ads directly to "lead forms" on platforms like Facebook and TikTok. However, having your own landing page or "advertorial" site often increases lead quality. It allows you to pre-qualify the user before they submit their information, which can allow you to charge more for the lead.

How do I find buyers for my leads?

You can find buyers through affiliate networks (the "grocery stores" of leads) or by reaching out to local businesses directly. For example, if you generate mortgage leads, you can contact local brokers. Scaling pay per lead campaigns is easier when you have reliable buyers who can handle the volume you produce.

Is lead arbitrage legal?

Yes, lead arbitrage is completely legal. It is a standard business practice used by major corporations like LendingTree and Expedia. However, you must remain compliant with data privacy laws such as GDPR and CCPA. You must clearly disclose to the user that their data may be shared with partners. Transparency is key to building a sustainable business in this space.

How much money do I need to start lead flipping?

You do not need millions, but you do need a testing budget. Since you are paying for ads upfront, you need enough capital to gather data and optimize your campaigns before you become profitable. Typically, a few thousand dollars is recommended to start testing different creatives and audiences effectively.

What niches are best for lead arbitrage?

High-ticket service-based niches work best. This includes mortgage, solar, insurance, debt settlement, and legal services. These industries have high customer values, meaning companies are willing to pay a premium for valid leads. Low-ticket items usually do not offer enough margin to make the arbitrage math work.

Do I need a website for lead arbitrage?

Not necessarily, but it helps. You can run ads directly to "lead forms" on platforms like Facebook and TikTok. However, having your own landing page or "advertorial" site often increases lead quality. It allows you to pre-qualify the user before they submit their information, which can allow you to charge more for the lead.

How do I find buyers for my leads?

You can find buyers through affiliate networks (the "grocery stores" of leads) or by reaching out to local businesses directly. For example, if you generate mortgage leads, you can contact local brokers. Scaling pay per lead campaigns is easier when you have reliable buyers who can handle the volume you produce.

Conclusion

Lead arbitrage offers a pathway to build a scalable, high-profit business without the operational headaches of physical products. By mastering the art of buying attention cheaply and selling data at a premium, you become a valuable asset in the digital economy. Whether you are a solo media buyer or a large agency, the principles of the pay per lead model, math, creative testing, and quality control are universal.

If you are ready to explore high-level strategies for your campaigns, partnering with a team that understands these dynamics is essential. You need experts who can navigate Facebook ads Los Angeles markets and beyond. Start now or you will fall behind as the industry shifts toward performance-based models.

For more insights on this topic, check out our blog on how to fix failing ads in the current landscape.

Lead arbitrage offers a pathway to build a scalable, high-profit business without the operational headaches of physical products. By mastering the art of buying attention cheaply and selling data at a premium, you become a valuable asset in the digital economy. Whether you are a solo media buyer or a large agency, the principles of the pay per lead model, math, creative testing, and quality control are universal.

If you are ready to explore high-level strategies for your campaigns, partnering with a team that understands these dynamics is essential. You need experts who can navigate Facebook ads Los Angeles markets and beyond. Start now or you will fall behind as the industry shifts toward performance-based models.

For more insights on this topic, check out our blog on how to fix failing ads in the current landscape.

Want this done for you? Our team turns Meta & Google ads into profitable, scalable growth using AI-powered strategy. Hire us.

Author:

Rafael Hernandez

|

CEO and Co-Founder of Great Marketing AI

Published:

Jan 3, 2026

About the author

Rafael Hernandez

Rafael Hernandez is the CEO and Founder of Great Marketing AI, an agency built to fuse technical excellence with creative firepower. A UC Berkeley graduate and former Microsoft engineer, Rafael combines world-class marketing with AI-powered systems that turn clicks into clients. He leads with speed, high standards, and a commitment to meaningful results.

About the Author

Rafael Hernandez

Rafael Hernandez is the CEO and Founder of Great Marketing AI, an agency built to fuse technical excellence with creative firepower. A UC Berkeley graduate and former Microsoft engineer, Rafael combines world-class marketing with AI-powered systems that turn clicks into clients. He leads with speed, high standards, and a commitment to meaningful results.

Ready to Scale Your Law Firm with Exclusive Leads?

Stop chasing low-quality leads. Partner with the #1 Hispanic Marketing Agency to capture the untapped Spanish-speaking MVA market.

About Great Marketing AI

Great Marketing AI is a specialized legal and hispanic marketing agency focused on helping law firms dominate the Hispanic market. We combine advanced data analytics with cultural expertise to generate high-intent Spanish MVA leads that convert into signed cases.

Case Studies

NP Digital: 800% Growth & 81% Cost Reduction in 5 Days

When a leading performance-marketing agency (NP Digital) discovered their own Meta ads were under-performing, they partnered with Great Marketing AI.

In just five days we rebuilt their campaigns—better targeting, scroll-stopping creative, and pixel optimization.

The result? 63 conversions (vs 7) + cost per result down from $284.77 to $52.74 + click-through rate up 71.7%.

Albert Preciado: 435% Revenue Surge • 526% Sales Growth

After relying on Instagram “boosts,” Albert’s business was stuck in visibility mode—not high-conversion mode. We stepped in with a full funnel makeover: precise Meta Ads targeting, Hyros tracking, and high-impact creative.

• $373 ,982 in revenue in 3 months = 2.89x ROAS (435% up)

• 6,228 leads (up 289%)

• 338 sales (up 526%)

• 798 qualified calls (up 375%)

• CPA down 41% to $779.71

Turning Steel into Gold” – 1,956% ROI & 20.56× ROAS

When Complex Steel Buildings, a Southern-California custom-steel-structure manufacturer, needed to scale and streamline their lead-generation process, we partnered with them to implement

• A hyper-targeted Meta Ads-based campaign

• Friction-free on-platform lead-capture

• Fully automated follow-up using GoHighLevel

The result: $12.2 K ad spend → $251 K in sales in 6 months (1,956% ROI) with 20.56× ROAS.

Nestor Gutierrez: 11× ROAS • Coaching Offer Launched in Days

With only $1,619 in ad spend, Great Marketing AI generated 105 lead-form submissions, 98 high-quality leads, and closed 9 deals for Nestor—delivering $17,768 in revenue and a Cost-Per-Sale of just $179.92.From an unlaunched offer to a predictable revenue system—built using Meta Ads + streamlined follow-up automation.

KCB Plumbing: 375% More Organic Traffic • 119% Direct Uplift in 90 Days

KCB was spending money on ads—but conversions stagnated. Great Marketing AI rebuilt their digital foundation: rewriting messaging, redesigning the site with conversion in mind, and layering AI-driven CRO best practices.• Direct traffic users up 119.23% in 90 days.

• Organic search users increased 375% in the same period.

• Engaged sessions from organic search jumped 400%; average engagement time up 114.94%.

8.16× ROAS • $14,500 Revenue from Just $1.8K Ad Spend

Faced with no consistent way to attract high-ticket coaching clients, Palomino turned to Great Marketing AI. We built a full-funnel acquisition engine — from precision Meta Ads to AI-powered content and automated lead-nurture workflows.

• 192 qualified opportunities created in the funnel.

• $1,775.70 ad spend → $14,500 in revenue.

• Cost per Sale (CPS): $887.85 — efficient for a premium coaching program.

The Kitchen Store: Website Remodel That Revamped Lead Flow

With 60 years of showroom legacy in Culver City, The Kitchen Store had solid prestige—but their website wasn’t doing it justice. Great Marketing AI stepped in and turned the digital storefront into a real conversion engine.

• Outdated site → full redesign: high-end visuals, mobile optimization, trust elements up front.

• Simplified the buyer journey: prominent CTA “Schedule a FREE Design Consultation,” easier forms, sticky navigation.

• Early wins: more form submissions, deeper engagement, improved handoff from ads to conversion.

NP Digital: 800% Growth & 81% Cost Reduction in 5 Days

When a leading performance-marketing agency (NP Digital) discovered their own Meta ads were under-performing, they partnered with Great Marketing AI.

In just five days we rebuilt their campaigns—better targeting, scroll-stopping creative, and pixel optimization.

The result? 63 conversions (vs 7) + cost per result down from $284.77 to $52.74 + click-through rate up 71.7%.

Albert Preciado: 435% Revenue Surge • 526% Sales Growth

After relying on Instagram “boosts,” Albert’s business was stuck in visibility mode—not high-conversion mode. We stepped in with a full funnel makeover: precise Meta Ads targeting, Hyros tracking, and high-impact creative.

• $373 ,982 in revenue in 3 months = 2.89x ROAS (435% up)

• 6,228 leads (up 289%)

• 338 sales (up 526%)

• 798 qualified calls (up 375%)

• CPA down 41% to $779.71

Turning Steel into Gold” – 1,956% ROI & 20.56× ROAS

When Complex Steel Buildings, a Southern-California custom-steel-structure manufacturer, needed to scale and streamline their lead-generation process, we partnered with them to implement

• A hyper-targeted Meta Ads-based campaign

• Friction-free on-platform lead-capture

• Fully automated follow-up using GoHighLevel

The result: $12.2 K ad spend → $251 K in sales in 6 months (1,956% ROI) with 20.56× ROAS.

Nestor Gutierrez: 11× ROAS • Coaching Offer Launched in Days

With only $1,619 in ad spend, Great Marketing AI generated 105 lead-form submissions, 98 high-quality leads, and closed 9 deals for Nestor—delivering $17,768 in revenue and a Cost-Per-Sale of just $179.92.From an unlaunched offer to a predictable revenue system—built using Meta Ads + streamlined follow-up automation.

KCB Plumbing: 375% More Organic Traffic • 119% Direct Uplift in 90 Days

KCB was spending money on ads—but conversions stagnated. Great Marketing AI rebuilt their digital foundation: rewriting messaging, redesigning the site with conversion in mind, and layering AI-driven CRO best practices.• Direct traffic users up 119.23% in 90 days.

• Organic search users increased 375% in the same period.

• Engaged sessions from organic search jumped 400%; average engagement time up 114.94%.

8.16× ROAS • $14,500 Revenue from Just $1.8K Ad Spend

Faced with no consistent way to attract high-ticket coaching clients, Palomino turned to Great Marketing AI. We built a full-funnel acquisition engine — from precision Meta Ads to AI-powered content and automated lead-nurture workflows.

• 192 qualified opportunities created in the funnel.

• $1,775.70 ad spend → $14,500 in revenue.

• Cost per Sale (CPS): $887.85 — efficient for a premium coaching program.

The Kitchen Store: Website Remodel That Revamped Lead Flow

With 60 years of showroom legacy in Culver City, The Kitchen Store had solid prestige—but their website wasn’t doing it justice. Great Marketing AI stepped in and turned the digital storefront into a real conversion engine.

• Outdated site → full redesign: high-end visuals, mobile optimization, trust elements up front.

• Simplified the buyer journey: prominent CTA “Schedule a FREE Design Consultation,” easier forms, sticky navigation.

• Early wins: more form submissions, deeper engagement, improved handoff from ads to conversion.

NP Digital: 800% Growth & 81% Cost Reduction in 5 Days

When a leading performance-marketing agency (NP Digital) discovered their own Meta ads were under-performing, they partnered with Great Marketing AI.

In just five days we rebuilt their campaigns—better targeting, scroll-stopping creative, and pixel optimization.

The result? 63 conversions (vs 7) + cost per result down from $284.77 to $52.74 + click-through rate up 71.7%.

Albert Preciado: 435% Revenue Surge • 526% Sales Growth

After relying on Instagram “boosts,” Albert’s business was stuck in visibility mode—not high-conversion mode. We stepped in with a full funnel makeover: precise Meta Ads targeting, Hyros tracking, and high-impact creative.

• $373 ,982 in revenue in 3 months = 2.89x ROAS (435% up)

• 6,228 leads (up 289%)

• 338 sales (up 526%)

• 798 qualified calls (up 375%)

• CPA down 41% to $779.71

Turning Steel into Gold” – 1,956% ROI & 20.56× ROAS

When Complex Steel Buildings, a Southern-California custom-steel-structure manufacturer, needed to scale and streamline their lead-generation process, we partnered with them to implement

• A hyper-targeted Meta Ads-based campaign

• Friction-free on-platform lead-capture

• Fully automated follow-up using GoHighLevel

The result: $12.2 K ad spend → $251 K in sales in 6 months (1,956% ROI) with 20.56× ROAS.

Nestor Gutierrez: 11× ROAS • Coaching Offer Launched in Days

With only $1,619 in ad spend, Great Marketing AI generated 105 lead-form submissions, 98 high-quality leads, and closed 9 deals for Nestor—delivering $17,768 in revenue and a Cost-Per-Sale of just $179.92.From an unlaunched offer to a predictable revenue system—built using Meta Ads + streamlined follow-up automation.

KCB Plumbing: 375% More Organic Traffic • 119% Direct Uplift in 90 Days

KCB was spending money on ads—but conversions stagnated. Great Marketing AI rebuilt their digital foundation: rewriting messaging, redesigning the site with conversion in mind, and layering AI-driven CRO best practices.• Direct traffic users up 119.23% in 90 days.

• Organic search users increased 375% in the same period.

• Engaged sessions from organic search jumped 400%; average engagement time up 114.94%.

8.16× ROAS • $14,500 Revenue from Just $1.8K Ad Spend

Faced with no consistent way to attract high-ticket coaching clients, Palomino turned to Great Marketing AI. We built a full-funnel acquisition engine — from precision Meta Ads to AI-powered content and automated lead-nurture workflows.

• 192 qualified opportunities created in the funnel.

• $1,775.70 ad spend → $14,500 in revenue.

• Cost per Sale (CPS): $887.85 — efficient for a premium coaching program.

The Kitchen Store: Website Remodel That Revamped Lead Flow

With 60 years of showroom legacy in Culver City, The Kitchen Store had solid prestige—but their website wasn’t doing it justice. Great Marketing AI stepped in and turned the digital storefront into a real conversion engine.

• Outdated site → full redesign: high-end visuals, mobile optimization, trust elements up front.

• Simplified the buyer journey: prominent CTA “Schedule a FREE Design Consultation,” easier forms, sticky navigation.

• Early wins: more form submissions, deeper engagement, improved handoff from ads to conversion.

NP Digital: 800% Growth & 81% Cost Reduction in 5 Days

When a leading performance-marketing agency (NP Digital) discovered their own Meta ads were under-performing, they partnered with Great Marketing AI.

In just five days we rebuilt their campaigns—better targeting, scroll-stopping creative, and pixel optimization.

The result? 63 conversions (vs 7) + cost per result down from $284.77 to $52.74 + click-through rate up 71.7%.

Albert Preciado: 435% Revenue Surge • 526% Sales Growth

After relying on Instagram “boosts,” Albert’s business was stuck in visibility mode—not high-conversion mode. We stepped in with a full funnel makeover: precise Meta Ads targeting, Hyros tracking, and high-impact creative.

• $373 ,982 in revenue in 3 months = 2.89x ROAS (435% up)

• 6,228 leads (up 289%)

• 338 sales (up 526%)

• 798 qualified calls (up 375%)

• CPA down 41% to $779.71

Turning Steel into Gold” – 1,956% ROI & 20.56× ROAS

When Complex Steel Buildings, a Southern-California custom-steel-structure manufacturer, needed to scale and streamline their lead-generation process, we partnered with them to implement

• A hyper-targeted Meta Ads-based campaign

• Friction-free on-platform lead-capture

• Fully automated follow-up using GoHighLevel

The result: $12.2 K ad spend → $251 K in sales in 6 months (1,956% ROI) with 20.56× ROAS.

Nestor Gutierrez: 11× ROAS • Coaching Offer Launched in Days

With only $1,619 in ad spend, Great Marketing AI generated 105 lead-form submissions, 98 high-quality leads, and closed 9 deals for Nestor—delivering $17,768 in revenue and a Cost-Per-Sale of just $179.92.From an unlaunched offer to a predictable revenue system—built using Meta Ads + streamlined follow-up automation.

KCB Plumbing: 375% More Organic Traffic • 119% Direct Uplift in 90 Days

KCB was spending money on ads—but conversions stagnated. Great Marketing AI rebuilt their digital foundation: rewriting messaging, redesigning the site with conversion in mind, and layering AI-driven CRO best practices.• Direct traffic users up 119.23% in 90 days.

• Organic search users increased 375% in the same period.

• Engaged sessions from organic search jumped 400%; average engagement time up 114.94%.

8.16× ROAS • $14,500 Revenue from Just $1.8K Ad Spend

Faced with no consistent way to attract high-ticket coaching clients, Palomino turned to Great Marketing AI. We built a full-funnel acquisition engine — from precision Meta Ads to AI-powered content and automated lead-nurture workflows.

• 192 qualified opportunities created in the funnel.

• $1,775.70 ad spend → $14,500 in revenue.

• Cost per Sale (CPS): $887.85 — efficient for a premium coaching program.

The Kitchen Store: Website Remodel That Revamped Lead Flow

With 60 years of showroom legacy in Culver City, The Kitchen Store had solid prestige—but their website wasn’t doing it justice. Great Marketing AI stepped in and turned the digital storefront into a real conversion engine.

• Outdated site → full redesign: high-end visuals, mobile optimization, trust elements up front.

• Simplified the buyer journey: prominent CTA “Schedule a FREE Design Consultation,” easier forms, sticky navigation.

• Early wins: more form submissions, deeper engagement, improved handoff from ads to conversion.

About Rafael Hernandez

Rafael Hernandez is the CEO and Founder of Great Marketing AI, a specialized legal marketing agency that helps law firms dominate the Hispanic market with exclusive MVA leads.

A UC Berkeley graduate and former Microsoft engineer, Rafael combines world-class marketing with AI-powered systems that turn clicks into clients.

He leads with speed, high standards, and a commitment to meaningful results.

How Can We Help You?

Our Clients

Trusted by 100+ happy customers worldwide

Learn more about Great Marketing AI →

FAQ

Have any questions?

Your burning questions, answered swiftly and succinctly.

Get Spanish MVA Leads

FAQ

Have any questions?

Your burning questions, answered swiftly and succinctly.

Get Spanish MVA Leads

FAQ

Have any questions?

Your burning questions, answered swiftly and succinctly.

Get Spanish MVA Leads